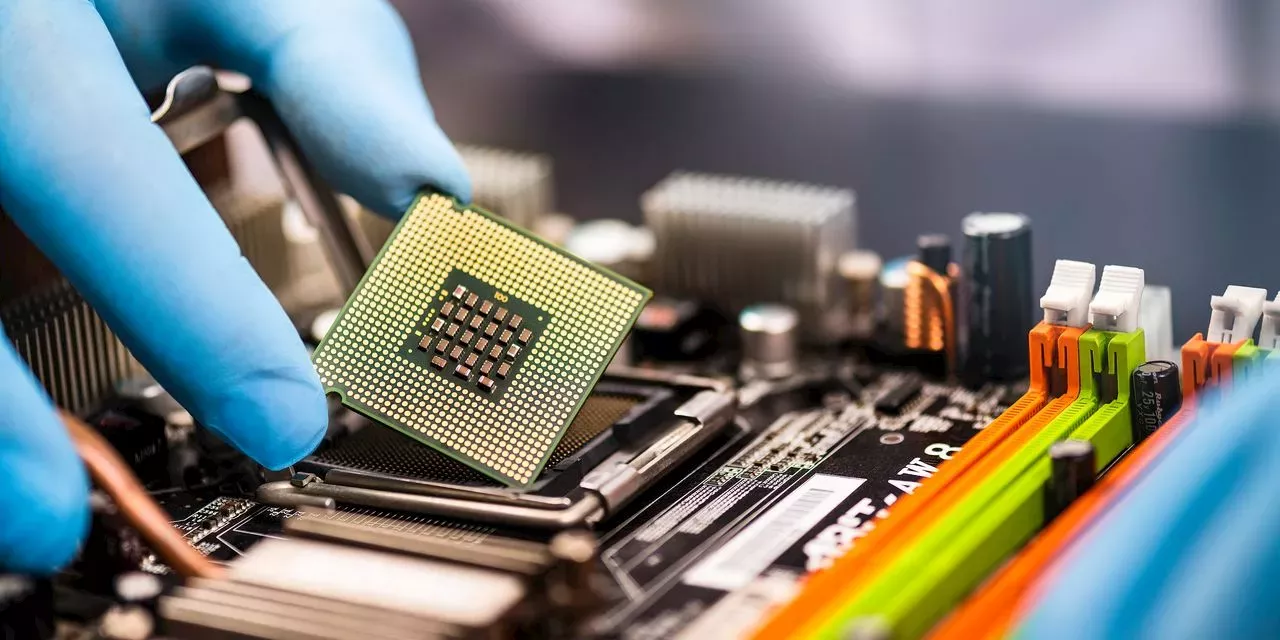

A seismic shift is happening in the semiconductor industry right now. This transformation is not merely a technological evolution; it’s a financial game-changer that will significantly impact the portfolios of many investors.

Fabless companies are less needed Fabless semiconductor companies such as Broadcom AVGO, +1.14%, Qualcomm QCOM, +1.76% and Advanced Micro Devices AMD, +4.19% have four key attributes that combine to form their value proposition: intellectual property; software/integration; talent/know-how, and distribution. Yet as big tech companies grow in both scale and technological capability, the relative value of fabless companies diminishes in value.

Build or buy? Despite the huge incentive the tech giants have to switch to in-house silicon, it is not always a straightforward decision. Companies must consider scale, as the volume of chips needed must justify the cost and effort of in-house design. Capability is another crucial factor. Only the largest companies like Apple and Tesla have the talent, intellectual property, and capital to design their own chips.

Currently, only TSMC, Intel, and Samsung have the capabilities to manufacture the world’s most advanced chips. These companies are also making significant investments in additional foundries in the U.S. and Europe, and they are attempting to diversify geographically away from dependence on Taiwan.

ประเทศไทย ข่าวล่าสุด, ประเทศไทย หัวข้อข่าว

Similar News:คุณยังสามารถอ่านข่าวที่คล้ายกันนี้ซึ่งเรารวบรวมจากแหล่งข่าวอื่น ๆ ได้

Stock Market Today: Dow holds gains, Treasury yields drop as Fed leaves rates unchangedLive coverage of a major day for the U.S. stock market with Treasury refunding and a Fed decision.

Stock Market Today: Dow holds gains, Treasury yields drop as Fed leaves rates unchangedLive coverage of a major day for the U.S. stock market with Treasury refunding and a Fed decision.

อ่านเพิ่มเติม »

E.l.f.’s stock jumps 10% on earnings, revenue beat; strong guidanceJon Swartz is a senior reporter for MarketWatch in San Francisco, covering many of the biggest players in tech, including Netflix, Facebook and Google. Jon has covered technology for more than 20 years, and previously worked for Barron's and USA Today. Follow him on Twitter jswartz.

E.l.f.’s stock jumps 10% on earnings, revenue beat; strong guidanceJon Swartz is a senior reporter for MarketWatch in San Francisco, covering many of the biggest players in tech, including Netflix, Facebook and Google. Jon has covered technology for more than 20 years, and previously worked for Barron's and USA Today. Follow him on Twitter jswartz.

อ่านเพิ่มเติม »