The Core Producer Price Index (PPI) measures the change in the selling price of goods and services sold by producers, excluding food and energy. The PPI measures price change from the perspective of the seller. When producers pay more for goods and services, they are more likely to pass the higher costs to the consumer, so PPI is thought to be a leading indicator of consumer inflation.

A higher than expected reading should be taken as positive/bullish for the USD, while a lower than expected reading should be taken as negative/bearish for the USD

United Kingdom United Kingdom Latest News, United Kingdom United Kingdom Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

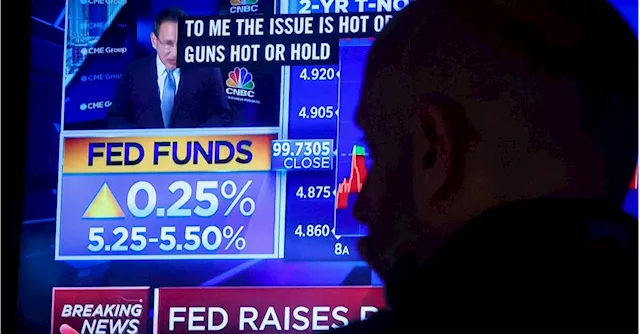

Goldilocks Moment for Stocks and Bonds as Inflation Data Supports Fed's StanceInvestors are hopeful that the Federal Reserve can bring down consumer prices without hurting the economy, creating a Goldilocks environment that benefits stocks and bonds. Inflation data released on Tuesday showed that consumer prices were unchanged in October, signaling a turning point.

Goldilocks Moment for Stocks and Bonds as Inflation Data Supports Fed's StanceInvestors are hopeful that the Federal Reserve can bring down consumer prices without hurting the economy, creating a Goldilocks environment that benefits stocks and bonds. Inflation data released on Tuesday showed that consumer prices were unchanged in October, signaling a turning point.

Read more »

US Consumer Price Inflation Cools, Stocks RiseUS consumer price inflation cools more than expected, sending US stocks sharply higher. The Consumer Price Index rose 3.2% for the 12 months ending in October, the lowest annual rate since March 2021.

US Consumer Price Inflation Cools, Stocks RiseUS consumer price inflation cools more than expected, sending US stocks sharply higher. The Consumer Price Index rose 3.2% for the 12 months ending in October, the lowest annual rate since March 2021.

Read more »

Stocks Rise Despite Caution from Citadel Founder and JPMorgan CEOStocks are pointing higher after Tuesday’s blockbuster session that pretty much declared the Fed’s rate-hike campaign over, sending bond prices soaring. Not everyone is at ease though, with both Citadel founder Ken Griffin and JPMorgan CEO Jamie Dimon cautioning that investors may be getting ahead of themselves. Indeed, they face a major blind spot, says the founder of hedge fund Praetorian Capital, Harris “Kuppy” Kupperman: “The government is about to go bankrupt. They should be looking at what happened in Zimbabwe and plan appropriately.

Stocks Rise Despite Caution from Citadel Founder and JPMorgan CEOStocks are pointing higher after Tuesday’s blockbuster session that pretty much declared the Fed’s rate-hike campaign over, sending bond prices soaring. Not everyone is at ease though, with both Citadel founder Ken Griffin and JPMorgan CEO Jamie Dimon cautioning that investors may be getting ahead of themselves. Indeed, they face a major blind spot, says the founder of hedge fund Praetorian Capital, Harris “Kuppy” Kupperman: “The government is about to go bankrupt. They should be looking at what happened in Zimbabwe and plan appropriately.

Read more »