As AI investors potentially look to book profits and rotate out of the "Magnificent Seven," I want to look at the battered-n-bruised software sector as an opportunity to buy an outperforming, standout name. Oracle , one of the top three largest U.S. based software companies, report earnings next week on June 11. I want to utilize an options strategy to create income and capitalize on ORCL moving higher.

mountain Oracle vs. the S & P 500 YTD Technically, Oracle is revealing strength as it sits above both its 50-day and 200-day moving averages. However, it is not showing any signs of being overbought with a Relative Strength reading of just 58. . Oracle's 52-week and all-time high is $132, a level that has the ability to be retested in Q3. In the event it is not, I am happy to add to my position and own more Oracle at a lower price for the longer term.

Click here for the full disclaimer.

United Kingdom United Kingdom Latest News, United Kingdom United Kingdom Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

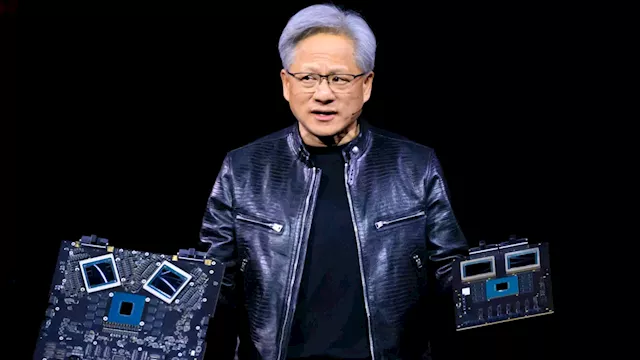

A chip stock hedge if the AI trend cools off a bit following Nvidia's earningsJeff Kilburg believes the AI theme could be due for a breather.

A chip stock hedge if the AI trend cools off a bit following Nvidia's earningsJeff Kilburg believes the AI theme could be due for a breather.

Read more »

A hedge on chip stocks if some of the profit-taking in Nvidia continuesJeff Kilburg constructs a hedge using a popular semiconductor ETF.

A hedge on chip stocks if some of the profit-taking in Nvidia continuesJeff Kilburg constructs a hedge using a popular semiconductor ETF.

Read more »

A market hedge for traders if you believe this May comeback is a head fakeJeff Kilburg believes that this recent Fed-induced rally will stall and gives an options position to capitalize on it.

A market hedge for traders if you believe this May comeback is a head fakeJeff Kilburg believes that this recent Fed-induced rally will stall and gives an options position to capitalize on it.

Read more »

A cautious way to make a bullish bet on one of the major stocks still left to report earningsMike Khouw gives the trading set-up on Oracle ahead of earnings.

A cautious way to make a bullish bet on one of the major stocks still left to report earningsMike Khouw gives the trading set-up on Oracle ahead of earnings.

Read more »