Moving markets today.Looking to recoup its losses, adding back $150 billion in market cap on Tuesday and video contributing two thirds of those gains.The big question is, what is the next catalyst going to be for the big tech sector we're going to discuss and Disney surprising investors with its first ever streaming profit, but it doesn't look like it's enough to offset the weakening parts demand.We certainly see consumers behaving in a way.

But clearly as the focus changes onto the monetization of A I from here on, you don't want to pay very high multiples and you want to see actually the monetization showing up in earnings and clearly this is a secular trend.What does that tell us if you are maybe seeing more of an opportunity now in tech, given the sell off or the drop that we had seen?Because here we are with the S and B just above 50,300.

If you look at earnings growth broadly speaking, S and P overall, close to 10% again, higher than long term averages, if anything, the only difference now is that the magnitude of surprise has come down across S and P which is fine.There are that said a few red flags. So for example, in discretionary, we are cautious that we like services exposure over goods exposure, right?

How is the approach that you're using today and now different maybe than those volatile or more dramatic moves that we had seen in the past?So I think there are big, big differences. For example, if you look at now what is happening in the delivers market, the whole term structure has gone up and two days ago, it completely inverted.So I think what is missing right now is if we don't have like in 2008, you had a housing and a mortgage crisis, right?

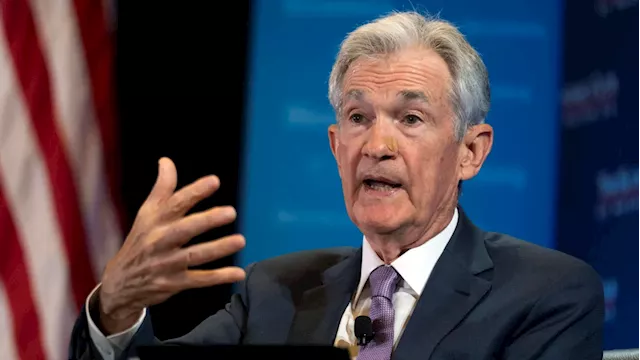

So I think when you look at a lot of and you have a fed which has learned from its past moves remains highly, highly data driven and focused. The amount of stimulus we injected into the economy was significantly higher than the amount of lost wages, post pandemic, right?So it goes on and on and yet we are doing fine, right?But I think these moves are very technical short covering systematic driven and they're not going to last.

It sort of makes sense to be a buyer or nibbler as some of the strategists that have come on air said, right?And saying I'm calling bottom, but it's ok if I was looking at sectors that I liked and they're all getting weighed down by some version of a yen carry trade and a short volatility spike in the big hitting 60.

Additionally, moving into a softer economy and a consumer that is watching their budgets, the parks got hurt and, and New Johnson can speak to getting to profitability and streaming, but the numbers are very small.Uh The businesses are diverse and I don't think investors really need to look at the near term opportunity uh because they can't put all these businesses align for positive growth.

Uh It's just really challenging uh against more streamlined companies like Netflix uh that are really uh ahead of the curve, you know, in this area of streaming, it's a very tough area to compete. You've got Paramount Warner Brothers Netflix, of course, among others, which of those names do you think stands to gain the most from capitalizing off a revenue moving forward?

Well, it was kind of a brush over on the quote, not much said there, but essentially that they're talking.Uh at least 9 billion, maybe more.Uh didn't like general entertainment.Uh the deal will get done.Um I'm, I'm not sure that's a driver or a catalyst for the stock.Thanks so much for hopping on here with us this morning, Director of Equity Research at CFR A.

And from that point forward, I think if management can guide the double digit earnings growth next year, eps growth next year, that's what investors are looking for now that we do have a change at the top here.Do you think that that is the right move?I think that a lot of investors were expecting that first, that they would miss the guidance that they revised to last quarter and that the real number was somewhere with a six handle on it on eps.

Yeah, the great question ma I think as I, as we look at the landscape, the political landscape and what it could do, right.Socks, these insurance company socks, I think CV S you know, is in that bucket, drug pricing is another area of focus for politicians as we think about the election.But I would say on a more fundamental basis, I mean, it, it's probably going to take more Congress than the presidential election to make these changes.

I think it's really interesting, particularly in comparison with some of the other results that we've gotten, particularly from a name like Amazon that didn't see as much of an upward take in their consumer driven e commerce business over the course of the quarter. That is when the, the Bank of Japan initiated its largest rate increase since 2007 that sent the Japanese Yen to a four month high against the dollar.

It's great to speak with you and honestly, you were the one person I really wanted to talk with over the course of the past couple of days because you are so good at understanding and giving context about market history.Well, thanks for having me on and I appreciate it. So Peter two part question here, I'm asking them both at the same time because they're a bit related.

So with this kind of correction, I think, yes, we'll probably get some near term volatility as confidence begins to rebuild. And that could leave the market vulnerable uh to some Pullbacks equally because of the concern about the weakening labor market. But the broader backdrop here is one of most likely continuing economic expansion together with the prospect of lower interest rates.

Even if they're in a structural market, you know, they do tend to have volatility and, and working through that is important. Uh And so I think that uh you know, uh the speed of those moves uh and scale of them and the breadth of them across global markets uh really uh led to a, a bit more supportive um uh at least uh rhetoric coming out of central banks.

But really when we take a look at the year to day chart, I think that's a little bit more informative. Despite all the negative headlines, people have been uh I don't want to say Diamond hands because there has been some selling, but people have been displaying some total tendencies in Bitcoin.Well, thank you, Jared for keeping us posted on the tendencies as always, really do appreciate it.

Uh It's clear that, you know, our customers are struggling and our job over here, uh besides delivering the, the results is also to make sure that we are providing value to our customers.There is no question that, you know, the entire sector is down.Uh and you know, the team is working around the clock to make sure that they deliver value to all of our customers.

I think we are the only uh convenience stores or uh a Qsr retailer in America that sell a chicken sandwich for $2.99.I don't think you actually have project like this or promotions like this.And I think, and again, the list go on and on and on. So I think it's a really partnership between the vendor community and us as a retailer to help the consumers uh during this time and during this pressure, it's not just the retailers that have the pricing power there.We got much more on catalyst right after this break and we're gonna continue to cover the market moves.

United Kingdom United Kingdom Latest News, United Kingdom United Kingdom Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

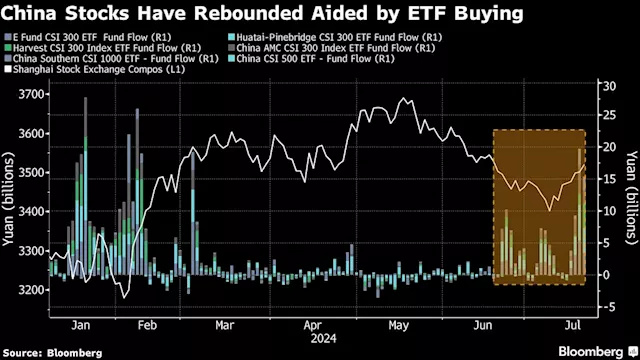

Chinese Stocks Decline as Third Plenum Falls Short on Catalysts(Bloomberg) -- Chinese stocks fell as the readout from a key conclave of Communist Party officials failed to convince investors about the economy’s new...

Chinese Stocks Decline as Third Plenum Falls Short on Catalysts(Bloomberg) -- Chinese stocks fell as the readout from a key conclave of Communist Party officials failed to convince investors about the economy’s new...

Read more »

September rate cut odds, latest bank earnings: CatalystsOn today's episode of Catalysts, Hosts Seana Smith and Madison Mills break down some of the biggest stories driving market action, from the possibility of a ...

September rate cut odds, latest bank earnings: CatalystsOn today's episode of Catalysts, Hosts Seana Smith and Madison Mills break down some of the biggest stories driving market action, from the possibility of a ...

Read more »

Big Tech's AI investments, Anheuser-Busch earnings: CatalystsToday on Catalysts, hosts Seana Smith and Madison Mills explore leading themes in the AI trade, the morning's top trending stocks, and the latest economic...

Big Tech's AI investments, Anheuser-Busch earnings: CatalystsToday on Catalysts, hosts Seana Smith and Madison Mills explore leading themes in the AI trade, the morning's top trending stocks, and the latest economic...

Read more »