A New York-based global brokerage and investment bank announced that it bought a “block of stock” in Abacore Capital Holdings Inc. citing the Philippine mining company’s undervalued stock price amid robust expansion and future growth potential.

The investment to ABA was made due to several factors, such as ABA’s robust expansion plans that will increase the company’s bottom line and boost shareholders’ return on their investments. Auerback Grayson also cited ABA’s stock has more room for growth due to the stock price being undervalued relative to its book value.

So far, in 2022, ABA is pursuing ventures with various business partners across a range of sectors. In mining, the company signed a coal exploration agreement with Oriental Vision Mining Philippines Inc. . Under this agreement, ORVI will conduct exploration work on three coal blocks ABA owns in the province of Surigao del Sur.

In relation to this, the company sold land to a subsidiary of A. Brown & Company for the development of a liquefied natural gas facility.

United States United States Latest News, United States United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

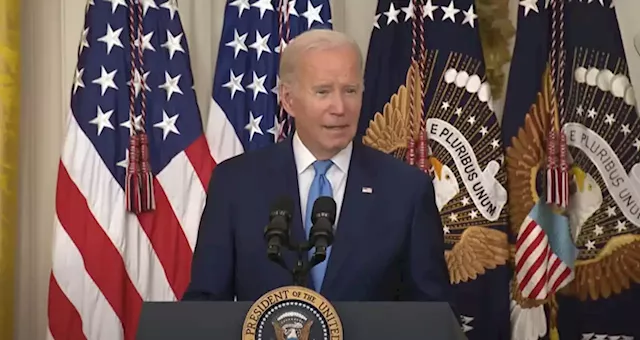

Biden signs order to block Chinese investment in US techU.S. President Joe Biden signed an executive order on Thursday that fortifies a regulatory committee’s powers to screen foreign investments in the U.S., many of which included Chinese shares in tech in recent years. The Committee on Foreign Investment in the United States (CFIUS), which was established in 1975 under the Ford administration, is now tasked with expanding its areas of review, as well as regularly evaluating its processes, practices and regulations to ensure that they “remain responsive to evolving national security threats.” While the order does not explicitly mention China, it names sectors that are fundamental to both U.S. technological leadership and national security, including “microelectronics, artificial intelligence, biotechnology and biomanufacturing, quantum computing, advanced clean energy and climate adaptation technologies.”

Biden signs order to block Chinese investment in US techU.S. President Joe Biden signed an executive order on Thursday that fortifies a regulatory committee’s powers to screen foreign investments in the U.S., many of which included Chinese shares in tech in recent years. The Committee on Foreign Investment in the United States (CFIUS), which was established in 1975 under the Ford administration, is now tasked with expanding its areas of review, as well as regularly evaluating its processes, practices and regulations to ensure that they “remain responsive to evolving national security threats.” While the order does not explicitly mention China, it names sectors that are fundamental to both U.S. technological leadership and national security, including “microelectronics, artificial intelligence, biotechnology and biomanufacturing, quantum computing, advanced clean energy and climate adaptation technologies.”

Read more »