The Merriam-Webster dictionary defines sentiment as, “an attitude, thought, or judgment prompted by feeling: predilection.: a specific view or notion: opinion.: emotion.: refined feeling: delicate sensibility especially as expressed in a work of art.: emotional idealism.”

Market sentiment is overly sensitive to statements and comments made by Federal Reserve officials because those individuals have the power and influence to change monetary policy. There is a dramatic difference between the perception of upcoming Federal Reserve monetary policy changes and the actions of Federal Reserve officials.

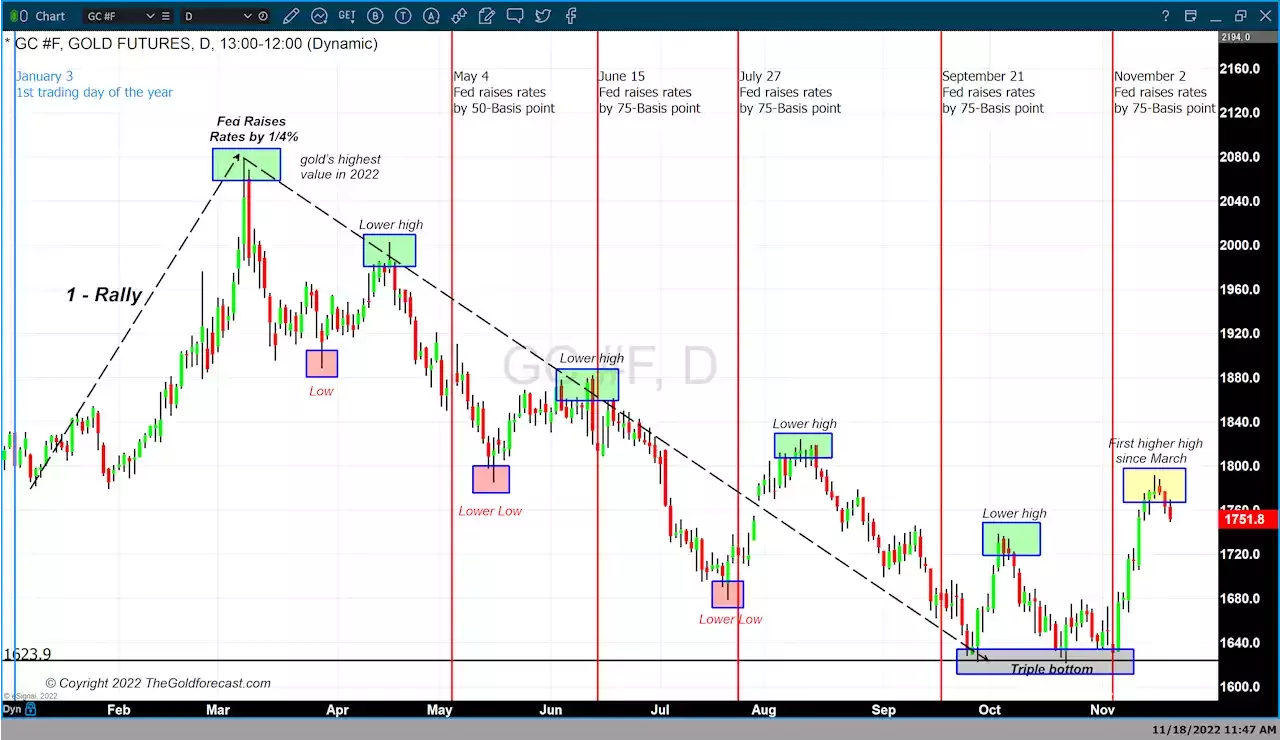

During the first week of November, market sentiment shifted because inflation rates had declined fractionally and investors viewed this fractional drop as a signal that the Federal Reserve would begin to loosen its aggressive monetary policy. This caused gold to rise dramatically from $1621 to an intraday high of $1792 by Tuesday, November 15. Because the CPI index dropped from 8.2% year-over-year in September to 7.

San Francisco Federal Reserve President Mary Daly, “It’s far from a victory”. Lorie Logan the Federal Reserve’s president of the Dallas central bank said that last week’s report is, “a welcome relief”, but will not alleviate the need for more rate increases possibly at a slower pace.

United States United States Latest News, United States United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Premarket: World stocks eye 1% weekly loss, U.S. yield curve indicates recessionStocks struggle after Fed officials fuel concerns about future rate hikes Quick. Change the definition of “recession”, again.

Premarket: World stocks eye 1% weekly loss, U.S. yield curve indicates recessionStocks struggle after Fed officials fuel concerns about future rate hikes Quick. Change the definition of “recession”, again.

Read more »