If you have a rental property, you don’t want it to sit vacant. It’s the same thing with the stock market. Yet so many people who own stocks just let them sit empty and unrented.Most investors in stocks are looking for the next hot market. They make their money gambling on the market going up or going down. You should know by now that that is not the way to generate consistent and predictable wealth.

Let’s consider, as an example, what happened with Microsoft. In 2000 Microsoft was trading at around seventy-six dollars. They were an expensive stock at the time, and a nice, upward-moving company. But then the market crashed in 2001, and Microsoft dropped to around twenty-two dollars. When the rest of the markets came back to the level at which they had been in 2000, Microsoft did not. They just floundered.

The typical investor who owned Microsoft during this time waited for the stock to recover. They either deciding to sell Microsoft to be done with it, or they waited the seventeen long years for that stock to come back to where it was when they bought it. A lot of traditional investors got bored with the stock, sold at a loss, and moved on. That is because they were using a traditional investor’s mindset and not doing what the wealthy do.

With stock rental we have a great batch of opportunities to increase our cash flow. Continuing with our example, Microsoft could have been be rented for about twenty to fifty cents per week. Hypothetically, with the 100 shares you own in Microsoft you could potentially rent it for 52 weeks out of the year for, let’s say, and average of $0.35. This means you could have brought in $35 for every week that you rented this stock.

United States United States Latest News, United States United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

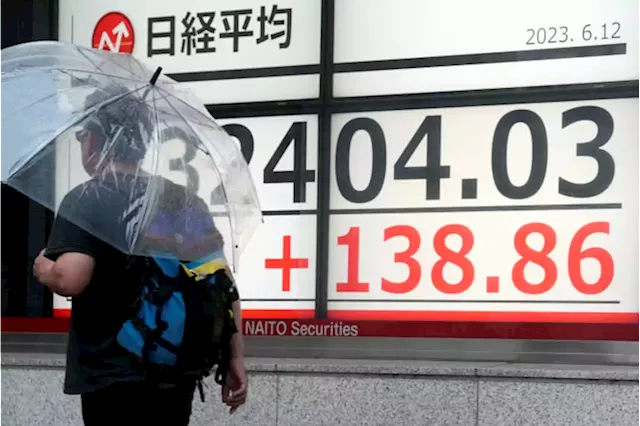

Asian Stock Market: Bulls and bears jostle at monthly top ahead of central bank decisionsAsian Stock Market: Bulls and bears jostle at monthly top ahead of central bank decisions – by anilpanchal7 Asia Equities RiskAversion CentralBanks Inflation

Asian Stock Market: Bulls and bears jostle at monthly top ahead of central bank decisionsAsian Stock Market: Bulls and bears jostle at monthly top ahead of central bank decisions – by anilpanchal7 Asia Equities RiskAversion CentralBanks Inflation

Read more »

Stock market today: Asian shares mixed as investors await Fed policy decision, price dataShares were mixed in Asia on Monday after the S&P 500 logged its fourth winning week in a row, while investors await another decision by the Federal Reserve on interest rates.

Stock market today: Asian shares mixed as investors await Fed policy decision, price dataShares were mixed in Asia on Monday after the S&P 500 logged its fourth winning week in a row, while investors await another decision by the Federal Reserve on interest rates.

Read more »