July 10, 2024 at 9:55AM EDT --

“There is no systemic sovereign default cycle in EM, and even the EM corp default rate YTD is well below trend,” said Uday Patnaik, head of emerging-market fixed income at Legal & General Investment Management Ltd. “EM relative to developed markets have been doing well in terms of growth, particularly the growth differential, FX reserves are at highs and significantly cover maturities and amortisations due this year.

Egypt has become a darling of investors ever since it bagged more than $57 billion in rescue funds from partners including the UAE and IMF. That, combined with a currency devaluation and interest-rate hike, fueled a rush into the carry-trade potential in Egyptian local assets.

United States United States Latest News, United States United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

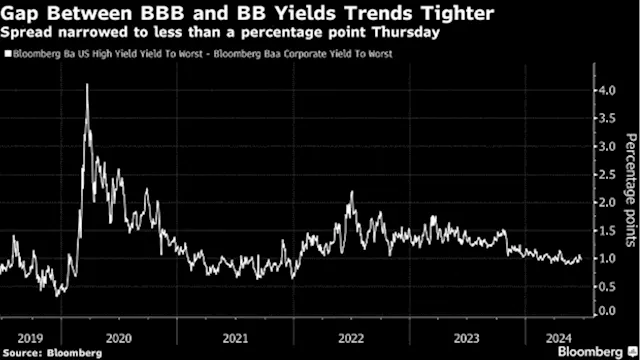

High-Grade Company Bonds Increasingly Trade Near Junk LevelsSome money managers that buy junk bonds have been pouring money into investment-grade notes instead, because the yields can be almost as high now.

High-Grade Company Bonds Increasingly Trade Near Junk LevelsSome money managers that buy junk bonds have been pouring money into investment-grade notes instead, because the yields can be almost as high now.

Read more »

Rally in Stocks and Bonds Will Power Past a Hawkish Fed, Survey ShowsThe S&P 500 will climb to new highs regardless of what the Fed does, according to a Bloomberg client survey.

Rally in Stocks and Bonds Will Power Past a Hawkish Fed, Survey ShowsThe S&P 500 will climb to new highs regardless of what the Fed does, according to a Bloomberg client survey.

Read more »

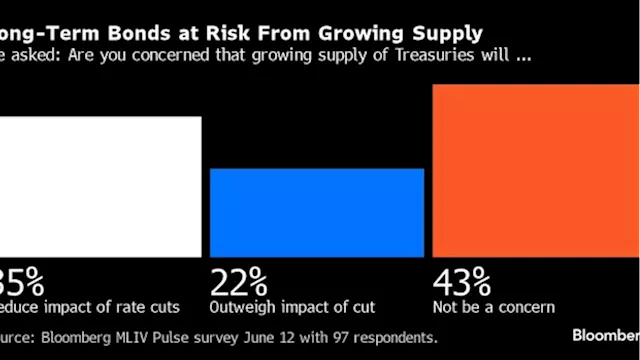

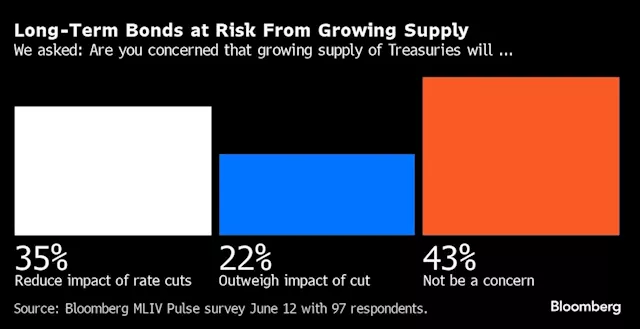

Rally in Stocks and Bonds Will Power Past a Hawkish Fed, Survey Shows(Bloomberg) -- Investors shed their fears of a hawkish Federal Reserve, according to Bloomberg’s latest Markets Live Pulse survey, signaling that slower...

Rally in Stocks and Bonds Will Power Past a Hawkish Fed, Survey Shows(Bloomberg) -- Investors shed their fears of a hawkish Federal Reserve, according to Bloomberg’s latest Markets Live Pulse survey, signaling that slower...

Read more »