Equity markets have been on a hot streak the past week, but uncertainty still looms around a variety of factors, including future economic data, upcoming corporate earnings, and the outlook on interest rate cuts. How should investors be positioning themselves in this environment?

For younger investors in the"accumulation phase," Saccaro recommends continuing to invest consistently through"dollar-cost averaging." In contrast, retirees should shift their focus from wealth accumulation to"protecting wealth." Saccaro advises these investors to concentrate on income-generating investments, such as those that provide interest and dividends.

If you don't need the income, then you can be a little more aggressive in stocks and a 6040 portfolio for someone who's retired, uh may actually be beneficial because that 40% and, and fixed income for the first time in something like 42 years has potential to be an actual capital appreciation play as well.

7 of the ultimate best Amazon deals to shop this weekend — plus 25+ more epic deals you need to see: Save up to 83% on tech, kitchen & moreHow many clothes do you actually need? There’s a magic number …Britten’s explosive work is a rallying cry at the Proms, while a twilit production of his chamber opera feels properly ghostlyThe GOP presidential nominee is laying the groundwork to deny the results of another election, raising alarms about a Jan. 6 repeat in 2025.

United States United States Latest News, United States United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

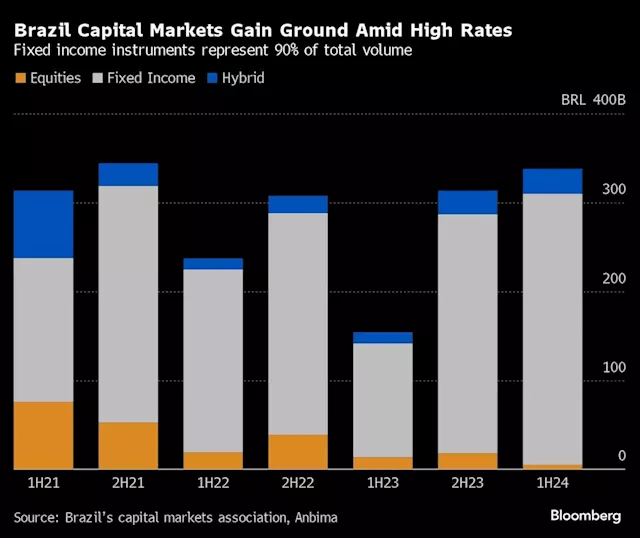

Brazil Plans to Help Mid-Sized Companies Tap Debt, Equity Markets(Bloomberg) -- Brazil is sketching out a plan to provide mid-sized companies with better access to the country’s capital markets, part of an effort by...

Brazil Plans to Help Mid-Sized Companies Tap Debt, Equity Markets(Bloomberg) -- Brazil is sketching out a plan to provide mid-sized companies with better access to the country’s capital markets, part of an effort by...

Read more »