NEW YORK, Feb 26 — US stocks are drawing buyers after a recent tumble, but some investors believe buying the dip this time may be a far riskier bet than in the past as markets face geopolitical strife and a hawkish Federal Reserve.

The S&P is down 8 per cent year-to-date and confirmed it was in a correction by falling more than 10 per cent from its record high earlier this week — its biggest decline since stocks lost nearly a third of their value in the Covid-19 selloff of March 2020 before doubling from their lows. Anticipation of Fed tightening has weighed on markets in recent weeks, as investors price in around 165 points of interest rate increases by next February. Fed Chairman Jerome Powell said he expected to raise interest rates in March for the first time since 2018.

“This is going to get worse before it gets better,” he told Reuters in a recent interview. “Asset managers don’t have these outcomes in their realm of possibilities.” In addition to the fast-moving situation in Ukraine, investors next week will be watching Friday’s non-farm payrolls data for February — the last such employment report the Fed will see before its monetary policy meeting in March.

BlackRock earlier this week added to its strategic overweight in equities, saying investors may be overestimating how hawkish central banks will need to be in their battle against inflation. JPMorgan’s analysts, meanwhile, argued that “initial volatility around rate liftoff didn’t last and equities made new all-time highs 2-4 quarters out.”

South Africa South Africa Latest News, South Africa South Africa Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

US stocks open sharply lower after Russia invades Ukraine | Malay MailNEW YORK, Feb 24 — Wall Street stocks opened sharply lower today, joining a global equity sell-off after Russia’s invasion of Ukraine lifted energy prices and prompted debate on further sanctions. About 20 minutes into trading, the Dow Jones Industrial Average was down 2.1 per cent at...

US stocks open sharply lower after Russia invades Ukraine | Malay MailNEW YORK, Feb 24 — Wall Street stocks opened sharply lower today, joining a global equity sell-off after Russia’s invasion of Ukraine lifted energy prices and prompted debate on further sanctions. About 20 minutes into trading, the Dow Jones Industrial Average was down 2.1 per cent at...

Read more »

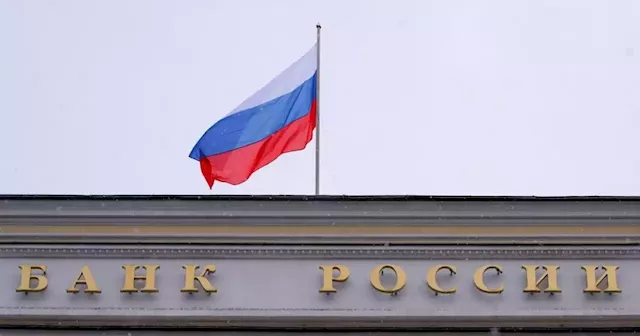

Russia ramps up aid to banks, forex market after invasion of Ukraine | Malay MailMOSCOW, Feb 24 — The Russian central bank beefed up the banking sector with extra liquidity and started to sell foreign currency on the forex market after the rouble fell to all-time lows on the day Moscow sent its troops into Ukraine. After weeks of denying plans to attack neighbouring Ukraine,... Hey, Forex and nfts are finally mixing with wolvesofnftst ,bro

Russia ramps up aid to banks, forex market after invasion of Ukraine | Malay MailMOSCOW, Feb 24 — The Russian central bank beefed up the banking sector with extra liquidity and started to sell foreign currency on the forex market after the rouble fell to all-time lows on the day Moscow sent its troops into Ukraine. After weeks of denying plans to attack neighbouring Ukraine,... Hey, Forex and nfts are finally mixing with wolvesofnftst ,bro

Read more »

Global finance grapples with Ukraine crisis as shares slump | Malay MailFRANKFURT, Feb 24 — Financial firms from Frankfurt to Wall Street suffered heavy share price falls today as they grappled with the impact of shockwaves from Russia’s invasion of Ukraine. Deutsche Bank, Germany’s largest lender, said it had contingency plans in place as US and European...

Global finance grapples with Ukraine crisis as shares slump | Malay MailFRANKFURT, Feb 24 — Financial firms from Frankfurt to Wall Street suffered heavy share price falls today as they grappled with the impact of shockwaves from Russia’s invasion of Ukraine. Deutsche Bank, Germany’s largest lender, said it had contingency plans in place as US and European...

Read more »