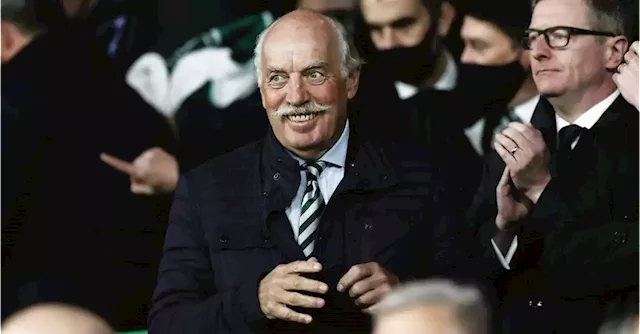

Dermot Smurfit jr, chief executive of GAN, the Las Vegas-based gambling software company: debt funding announcement comes after a difficult period for GAN in which its share price has slumped. Picture: Bryan Meade

GAN, Dermot Smurfit’s Las Vegas-based gambling software company, has struck a $30 million debt funding deal with Beach Point Capital, the American lender, which will help it return capital to its shareholders and pursue deals. The company said in an announcement last week that the funds would be “focused on funding existing high-return B2B investments”, meaning buying other businesses, as well as “execution of the previously announced $5 million share repurchase”....

South Africa South Africa Latest News, South Africa South Africa Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

China’s Covid lockdowns could cause ‘more trouble for Irish firms’ | Business PostBank of Ireland expert Conor Magee says increasing pressure from China’s lockdowns and the war in Ukraine is forcing Irish firms to change supply chains, ellied798 reports.

China’s Covid lockdowns could cause ‘more trouble for Irish firms’ | Business PostBank of Ireland expert Conor Magee says increasing pressure from China’s lockdowns and the war in Ukraine is forcing Irish firms to change supply chains, ellied798 reports.

Read more »

Desmond is key player in blank cheque mining firm’s potential €414m outlay | Business PostDermot Desmond has emerged as a key player behind a New York-listed blank cheque company looking to spend $414 million on African gold mining companies as a hedge against what it regards as central bank-driven inflation.

Desmond is key player in blank cheque mining firm’s potential €414m outlay | Business PostDermot Desmond has emerged as a key player behind a New York-listed blank cheque company looking to spend $414 million on African gold mining companies as a hedge against what it regards as central bank-driven inflation.

Read more »

Wayflyer backer is impressed by other Irish firms and keen to invest | Business PostLeft Lane Capital, the New York-based venture capital and growth equity firm that last year led a multimillion-euro funding round for tech unicorn Wayflyer, is keen to back other Irish companies, chastaylor reports.

Wayflyer backer is impressed by other Irish firms and keen to invest | Business PostLeft Lane Capital, the New York-based venture capital and growth equity firm that last year led a multimillion-euro funding round for tech unicorn Wayflyer, is keen to back other Irish companies, chastaylor reports.

Read more »