KUALA LUMPUR, June 10 — The Goods and Services Tax will be improved in terms of the efficiency of its reimbursement process, business compliance level as well as overall administration if the government decides to reintroduce the tax.

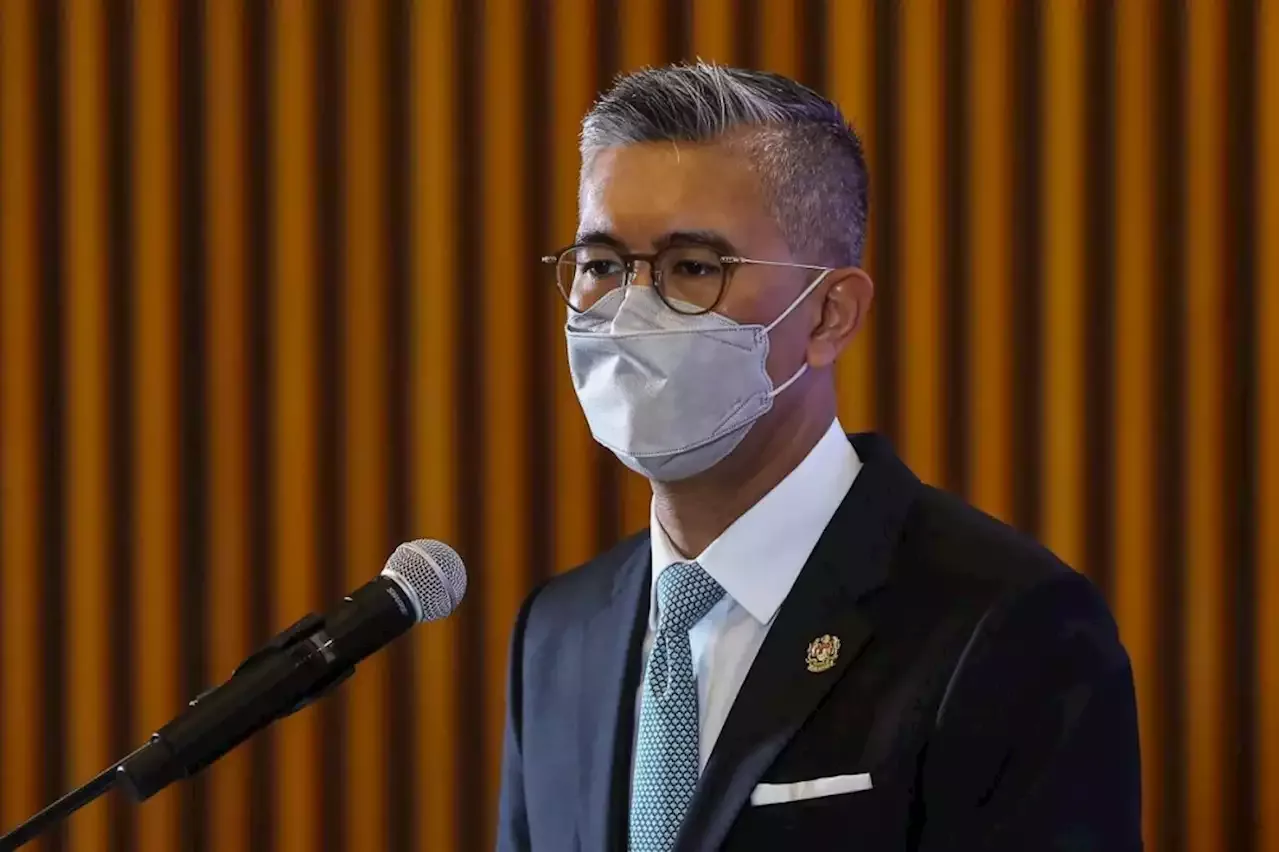

Tengku Zafrul noted that the national revenue collection as a percentage of gross domestic product last year was relatively low at 15.1 per cent compared with other countries in the region such as Singapore, Thailand and the Philippines. Tax revenue, meanwhile, stood at 11.2 per cent of GDP. On Budget 2023, Tengku Zafrul said it will, among others, focus on facilitating full employment and re-employment and social protection for those who are self-employed and working in the informal sector.

Improve. As i know of the capability and skills of the current government and its respected MP, I believe the only solution your brain can come up with, is to improve it from 6 to 10 percent.

wtf...

Improve on a tax scheme? Either you tax or you don’t. Oh is it going to be community based tax to gain popularity?

personally, GST better than what we practice now. bnyk taikun main harga, sorok barang, sorok hasil income & etc. patut masa PH, not abolish, tapi improve implementation. but popularis move, buat tak fikir. now BN nak buat balik Gst ikut kepala dia.. padan muka kita 🤣

Its a tax. Its just a matter of paying more or less. I betcha we do not have the luxury to say no to tax like some privilege.

😂😂😂😂😂

Syaitan manusia

Nak protect geng2 elit dia la tu

South Africa South Africa Latest News, South Africa South Africa Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Finance minister: Govt still studying all tax systems, including GSTFastest GST can be reimplemented is 6 months after greenlight, he adds. Do also study the tax for the uber rich ya tzafrul_aziz Pls also study those vvip which hav yet settled their tax. Before even goes to gst which will burden your dear rakyat! The best course of action is to implement the MST system !

Finance minister: Govt still studying all tax systems, including GSTFastest GST can be reimplemented is 6 months after greenlight, he adds. Do also study the tax for the uber rich ya tzafrul_aziz Pls also study those vvip which hav yet settled their tax. Before even goes to gst which will burden your dear rakyat! The best course of action is to implement the MST system !

Read more »

Finance minister: Govt still studying all tax systems including GSTPUTRAJAYA, June 8 — The government is still studying all tax systems in the world, including whether or not to reintroduce the Goods and Services Tax (GST) in the...

Finance minister: Govt still studying all tax systems including GSTPUTRAJAYA, June 8 — The government is still studying all tax systems in the world, including whether or not to reintroduce the Goods and Services Tax (GST) in the...

Read more »