Naturally, this decline has been a key focus in global investment circles, with the question front of mind for investors whether they should be considering switching out of stocks in case they fall even further, or whether now is a good time to be invested?

You don’t need to be a market expert to note that these themes from the Dot Com crash are once again prevalent in the current market environment, said Louw. In June 2022, the Fed surprised the market by hiking rates for the third time, but rather than increasing the Fed rate by 0.5% as expected, they decided to raise rates by 0.75%. This caused quite a few prominent economists to state that in their view, the US will undoubtedly go into recession, as was the case in the early 2000s. This all came to bear in the fact that the Nasdaq had its worst first half of the year on record in 2022.

South Africa South Africa Latest News, South Africa South Africa Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

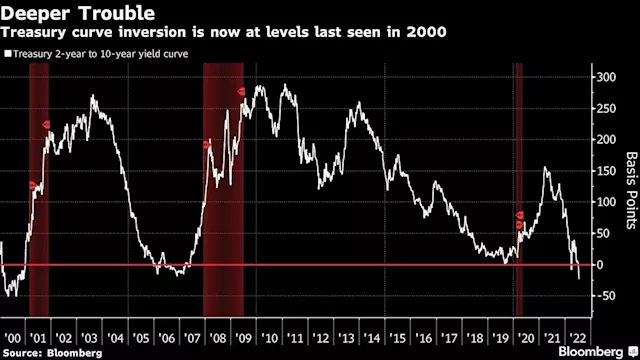

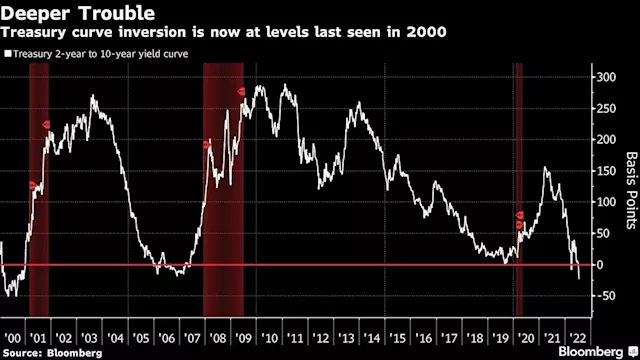

Business Maverick: Stocks, US futures pare drop as China tech gains: markets wrapUS Treasury two-year yields, sensitive to imminent Federal Reserve moves, climbed further while longer-maturity rates also went higher. The inversion between two-year and 10-year yields – a potential recession indicator – is the deepest since 2000.

Business Maverick: Stocks, US futures pare drop as China tech gains: markets wrapUS Treasury two-year yields, sensitive to imminent Federal Reserve moves, climbed further while longer-maturity rates also went higher. The inversion between two-year and 10-year yields – a potential recession indicator – is the deepest since 2000.

Read more »

Business Maverick: Stocks, US futures pare drop as China tech gains: markets wrapUS Treasury two-year yields, sensitive to imminent Federal Reserve moves, climbed further while longer-maturity rates also went higher. The inversion between two-year and 10-year yields – a potential recession indicator – is the deepest since 2000.

Business Maverick: Stocks, US futures pare drop as China tech gains: markets wrapUS Treasury two-year yields, sensitive to imminent Federal Reserve moves, climbed further while longer-maturity rates also went higher. The inversion between two-year and 10-year yields – a potential recession indicator – is the deepest since 2000.

Read more »

Business Maverick: Euro Drops to Dollar Parity for First Time in Two DecadesThe euro has suffered a swift and brutal slump this year, and now it’s crossed a major threshold for the first time in more than two decades: parity with the dollar.

Business Maverick: Euro Drops to Dollar Parity for First Time in Two DecadesThe euro has suffered a swift and brutal slump this year, and now it’s crossed a major threshold for the first time in more than two decades: parity with the dollar.

Read more »