As a result, they’re more willing to buy Treasury bills rather than parking cash in the Fed’s overnight reverse repurchase agreement facility, which pays an interest rate established by the central bank.

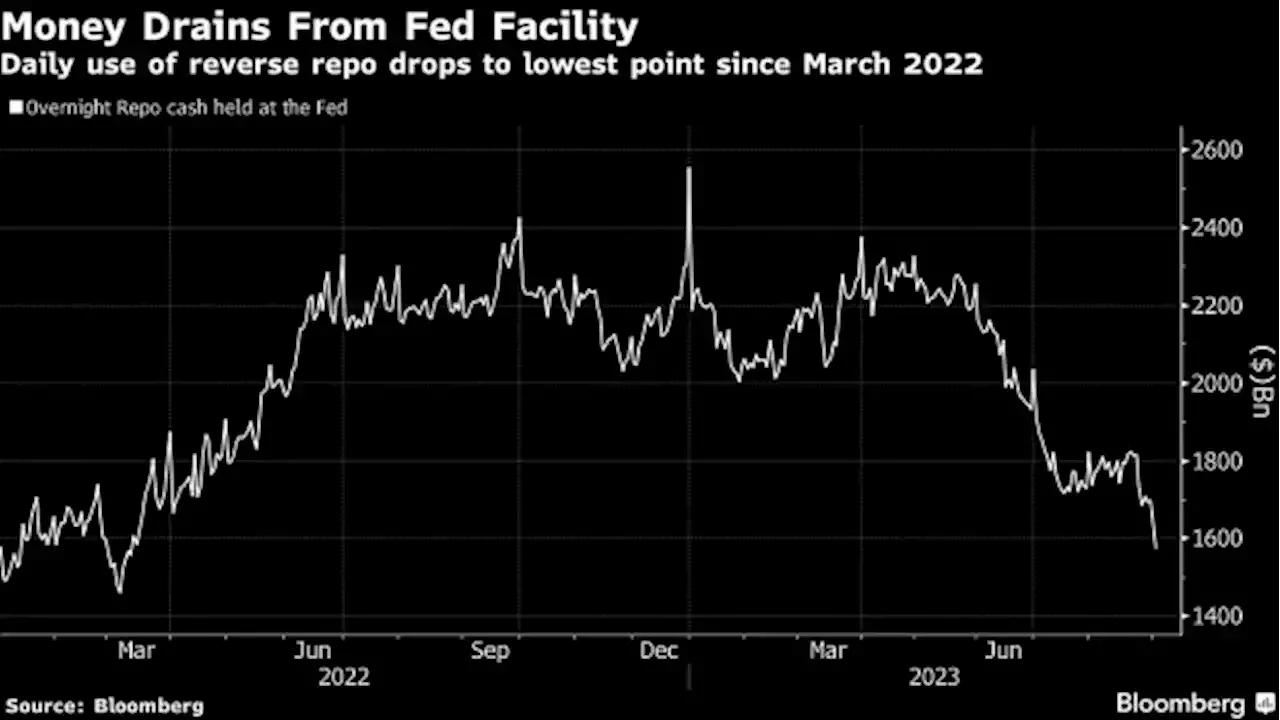

On Friday, 94 counterparties put $1.574 trillion in the facility, a drop of 4.7% from Thursday and the lowest total since March 2022. Usage of the RRP exceeded $2 trillion as recently as June 30 and has fallen by 13% this week. The main driver has been burgeoning Treasury bill supply, along with softer economic data that have damped expectations for additional Fed rate increases. August employment measures released Friday prompted traders to assign less than 50% odds to a quarter-point rate increase in November, down from 75% earlier in the week.

“Treasury has persisted with their net bill supply barrage which has led cash to move out of the RRP facility and into bills,” said Gennadiy Goldberg, head of US rates strategy at TD Securities. “Now that data has started to soften a bit and future hikes appear to be less likely, front-end investors are more comfortable buying bills and locking in returns.”

This week’s decline also coincided with Thursday’s settlement of Treasury notes sold in auctions Monday and Tuesday. Bill and coupon auctions raised nearly $394 billion for the US Treasury during August, “removing that cash from the market,” said John Canavan, fixed-income analyst at Oxford Economics.