It’s not the intensity of the drop that’s weighing on sentiment, but rather the fact that big down days are getting more frequent and there’s been a scarcity of large rebounds. Three of the six days when the S&P 500 lost more than 1% last quarter occurred since mid-September. And there were only two days when the index gained more than 1% in the quarter. That down-to-up ratio of three is the highest since 1994, data compiled by Bloomberg show.

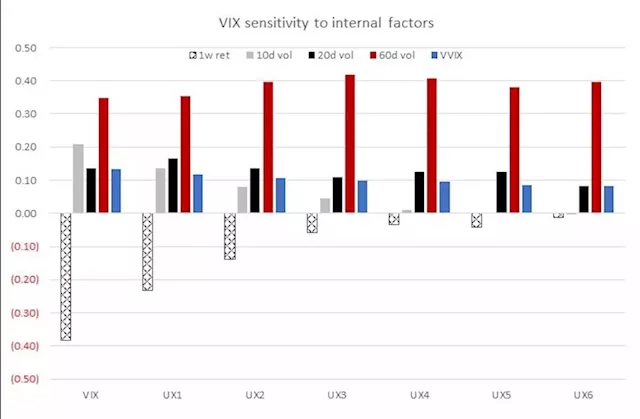

“We just have a lot of questions that are on people’s minds,” said Brian Donlin, an equity derivatives strategist at Stifel Nicolaus & Co. “You’ve seen a bit more hedging, a bit more risk of a real vol spike.” Count IUR Capital’s Gareth Ryan among those riding the wave of volatility. A day after the Fed reiterated its higher-for-longer stance, the firm’s managing director bought a put spread on the SPDR S&P 500 ETF Trust, wagering that stocks would fall and volatility rise. He trimmed some of that wager when the S&P bounced on Thursday. The VIX Index is at 17.52, above its close of 14.11 the evening before the rate-decision day.

Still, the latter part of September didn’t look good for equity bulls. Rising rate anxiety has likely weighed on sentiment. Also, share buybacks have been frozen for about 90% of S&P 500 firms amid a pre-earnings blackout, stripping the stock market of a big upward influence.

South Africa South Africa Latest News, South Africa South Africa Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Market Stress Rises Over Wild Week Ahead Even Without a Shutdown(Bloomberg) -- Investors have shown few signs of panic during a stock market slump that’s pushed the S&P 500 Index into its first losing quarter in a year. But beneath the surface, signs of stress are emerging that go far beyond the just averted US government shutdown. Most Read from BloombergSenate Voting on Bill to Avert US Government ShutdownOnce Unthinkable Bond Yields Now the New Normal For MarketsCongress Averts US Government Shutdown Hours Before DeadlineEurope’s Richest Royal Family Buil

Market Stress Rises Over Wild Week Ahead Even Without a Shutdown(Bloomberg) -- Investors have shown few signs of panic during a stock market slump that’s pushed the S&P 500 Index into its first losing quarter in a year. But beneath the surface, signs of stress are emerging that go far beyond the just averted US government shutdown. Most Read from BloombergSenate Voting on Bill to Avert US Government ShutdownOnce Unthinkable Bond Yields Now the New Normal For MarketsCongress Averts US Government Shutdown Hours Before DeadlineEurope’s Richest Royal Family Buil

Read more »

Nasdaq rises, but stocks give up gains to close out brutal month: Stock market news todayThe Nasdaq led gains on Friday, but the major stock indexes were on track for sharp monthly and quarterly losses on the final trading day of September.

Nasdaq rises, but stocks give up gains to close out brutal month: Stock market news todayThe Nasdaq led gains on Friday, but the major stock indexes were on track for sharp monthly and quarterly losses on the final trading day of September.

Read more »

LACKIE: September market stats will tell the tale of a market in transitionNow that September has come to a close, we can all wait with bated breath for the data that will show how the real estate market fared.

LACKIE: September market stats will tell the tale of a market in transitionNow that September has come to a close, we can all wait with bated breath for the data that will show how the real estate market fared.

Read more »

Labor market showing signs of 'hollowing out': ResearcherThe labor market appears to be showing resiliency after weekly U.S. jobless claims continue cooling. Economic Cycle Research Institute Co-Founder Lakshman Achuthan explains why these numbers might not necessarily suggest a positive for the labor market, as the rate of hiring has slowed down significantly. Achuthan notes to Yahoo Finance that “cyclical components” such as fewer temporary job opportunities and fewer working hours could be weighing on economic data. For more expert insight and the latest market action, click here to watch this full episode of Yahoo Finance Live.

Labor market showing signs of 'hollowing out': ResearcherThe labor market appears to be showing resiliency after weekly U.S. jobless claims continue cooling. Economic Cycle Research Institute Co-Founder Lakshman Achuthan explains why these numbers might not necessarily suggest a positive for the labor market, as the rate of hiring has slowed down significantly. Achuthan notes to Yahoo Finance that “cyclical components” such as fewer temporary job opportunities and fewer working hours could be weighing on economic data. For more expert insight and the latest market action, click here to watch this full episode of Yahoo Finance Live.

Read more »