A series of upcoming economic reports and Congressional testimony from Federal Reserve Chairman Jerome Powell could jolt U.S. government bonds out of a narrow trading range.

“The market has settled into a narrative that we may see incremental softness but not a growth scare,” said Garrett Melson, a portfolio strategist at Natixis Investment Managers Solutions. “That will continue to keep us in this range, but the one thing that will push it meaningfully lower is an increase in the unemployment rate.”

Other highlights for the month include consumer price data scheduled for July 11. Powell is scheduled to give his semiannual testimony on monetary policy on July 9 at the Senate Banking Committee, said the office of its chairman, Senator Sherrod Brown, on Monday. If tradition holds, the Fed Chair will deliver the same testimony at the House Financial Services committee the following day.

South Africa South Africa Latest News, South Africa South Africa Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

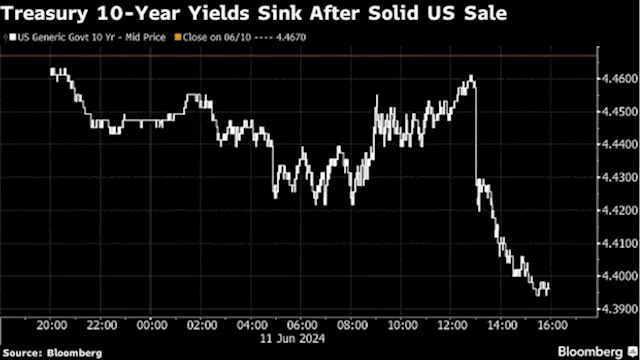

Bonds Rise on Treasury Sale; Asian Stocks to Fall: Markets WrapBonds climbed after a solid $39 billion Treasury sale triggered speculation that Wednesday’s inflation reading will help make the case for the Federal Reserve to cut rates this year. Asian stocks look set to shrug off the positive US session and track lower.

Bonds Rise on Treasury Sale; Asian Stocks to Fall: Markets WrapBonds climbed after a solid $39 billion Treasury sale triggered speculation that Wednesday’s inflation reading will help make the case for the Federal Reserve to cut rates this year. Asian stocks look set to shrug off the positive US session and track lower.

Read more »

Bonds Rise on Treasury Sale; Asian Stocks to Fall: Markets Wrap(Bloomberg) -- Bonds climbed after a solid $39 billion Treasury sale reflected speculation that Wednesday’s inflation reading will help make the case for the...

Bonds Rise on Treasury Sale; Asian Stocks to Fall: Markets Wrap(Bloomberg) -- Bonds climbed after a solid $39 billion Treasury sale reflected speculation that Wednesday’s inflation reading will help make the case for the...

Read more »