The rapid change has come about as oil rallied some 30% from the year’s low to alter the dynamics for developing nations. Costlier crude is reviving price pressures and damping hopes that interest rates will fall, while threatening to undermine the fiscal balances of energy importers.

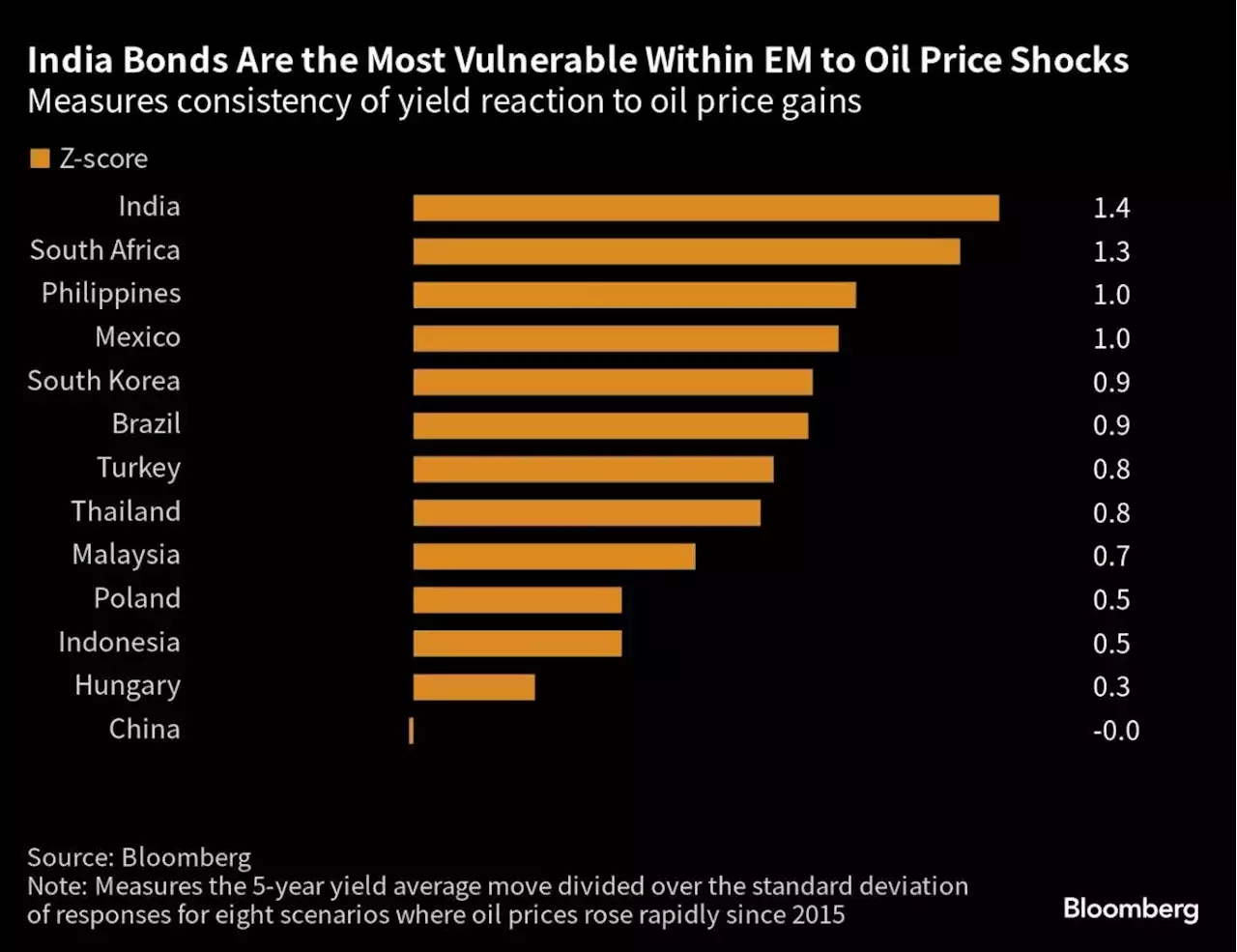

The cracks are starting to show. A Bloomberg gauge of emerging-market government bonds and an MSCI index of developing-nation currencies are both closing in on a second month of declines. HSBC Holdings Plc notes that South Africa’s bonds may also suffer given the nation’s status as a net oil importer. At the other end of the spectrum, GlobalData TS Lombard reckons Chinese debt will be the most resilient as high oil prices help normalize producer price disinflation.

“Higher oil prices will likely act as a tax on other economies which are net importers, reducing real incomes and slowing growth,” said Marcella Chow, global market strategist at JPMorgan Asset Management. “This could put downward pressure on their currencies and their central banks may need to maintain interest rates at the current level, or even raise rates, to protect their currencies.”

Business Business Latest News, Business Business Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Oil’s rally cools as tight crude market vies with hawkish U.S. FedOil eased off yearly highs, capping a tumultuous week that saw the U.S. Federal Reserve flagging a further rate hike and Russia banning diesel exports.

Oil’s rally cools as tight crude market vies with hawkish U.S. FedOil eased off yearly highs, capping a tumultuous week that saw the U.S. Federal Reserve flagging a further rate hike and Russia banning diesel exports.

Read more »