Lithium’s going to get less expensive in 2023, according to a Chinese supplier of the battery metal, potentially offering some relief to electric-vehicle makers squeezed by soaring costs.

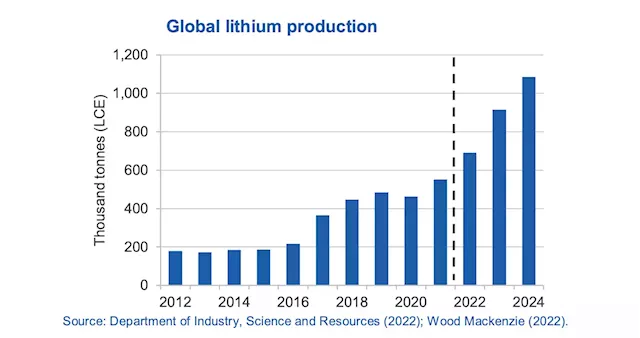

Lithium’s relentless rise since 2020 has hurt buyers and contributed to the first annual increase in battery costs sincestarted tracking them nearly a decade ago. Benchmark prices in China are still about twice as high as the start of 2022 — despite declining this month — as demand from the fast-expanding EV sector outstrips supply.

Wang’s comments echo some other forecasts. More mine supply will push the market into a surplus next year and help soften prices, BYD’s Executive Vice President Stella Li said earlier this month. China’s withdrawal of EV credits, as well as uncertainties over the pandemic and global economy, are also weighing on the outlook.

Sinomine wants to expand output worldwide, just as geopolitical tensions are growing with the US, Canada and other nations that are moving to restrict China’s role in the EV supply chain.

대한민국 최근 뉴스, 대한민국 헤드 라인

Similar News:다른 뉴스 소스에서 수집한 이와 유사한 뉴스 기사를 읽을 수도 있습니다.

Australia's Lithium Export Earnings Expected To Exceed $16 Billion In 2022–2023Australia’s Lithium Export Earnings Expected To Exceed $16 Billion In 2022–2023

Australia's Lithium Export Earnings Expected To Exceed $16 Billion In 2022–2023Australia’s Lithium Export Earnings Expected To Exceed $16 Billion In 2022–2023

더 많은 것을 읽으십시오 »